Loading...

The Internet of Things is emerging as the third wave in the development of the internet. While the fixed internet that grew up in the 1990s connected 1 billion users via PCs, and the mobile internet of the 2000s connected 2 billion users via smartphones (on its way to 6 billion), the IoT is expected to connect 28 billion “things” to the internet by 2020, ranging from wearable devices such as smartwatches to automobiles, appliances, and industrial equipment. The repercussions span industries and regions.

At Goldman Sachs, we see numerous triggers turning the IoT from a futuristic buzzword to a reality. The cost of sensors, processing power, and bandwidth to connect devices has dropped low enough to spur widespread deployment. Innovative products like fitness trackers and Google’s Nest thermostats are demonstrating the potential for both consumers and enterprises. And corporate alliances are taking shape to set the standards needed to integrate the wide array of devices in a cohesive way.

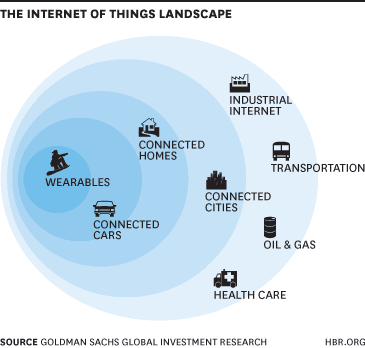

While these enablers make the IoT possible, its long-term success depends on the use cases that help realize the economic potential of connecting billions of devices, either to improve quality of life or save money. We focus on five key verticals where the IoT will be tested first: Connected Wearable Devices, Connected Cars, Connected Homes, Connected Cities, and the Industrial Internet.

Early adopters in these verticals are using the IoT to pioneer new product areas and to find efficiencies that save money or reduce demand for resources. In wearable devices, new consumer categories are emerging in fitness bands, action cameras, smart watches and smart glasses. Cars are becoming more connected with each new model, driven by infotainment, navigation, safety, diagnostics, and fleet management. Consumers in these verticals are able to see the internet extended beyond desktops and mobile devices.

Connected Homes are perhaps the clearest next proving ground for the IoT, combining both the potential to spawn new lines of products and services in areas such as security cameras and kitchen appliances, and the chance to reduce energy use and costs through smart thermostats and HVAC systems.

We believe this segment could generate meaningful revenue in the near term. Samsung said at its 2014 investors forum it expects the global Smart Home Device market to reach $15 billion in 2015, almost doubling from 2013’s $7.8 billion. Samsung expects the bulk of this opportunity to be driven by the U.S., U.K., Australia and China.

In connected cities, the U.S. has emerged as a leading adopter of smart meter technology for power utilities, approaching 50% penetration of 150 million total endpoints. The initial foray into connected cities was catalyzed by over $3 billion in stimulus funding and support for smart grid technology as part of the 2009 American Recovery and Restoration Act. Government initiatives are likely to drive growth internationally as well. In Europe there is a target for 80% of households to have smart meters by 2020.

Smart meters and the grid network architecture lay the foundation for further connectivity throughout cities, including smart street lighting, parking meters, traffic lights, electric vehicle charging, and others. According to The Climate Group, a non-profit organization dedicated to reducing carbon use, combining LED lamps in streetlights with smart controls can reduce CO2 emissions by 50%-70%.

Within the vast Industrials sector, the IoT represents a structural change akin to the industrial revolution. Equipment is becoming more digitized and more connected, establishing networks between machines, humans, and the internet and creating new ecosystems. While we are still in the nascent stages of adoption, we believe the Industrial IoT opportunity could amount to $2 trillion by 2020. Included within this Industrial category are numerous sectors, from transportation to health care to oil and gas, each of which will be affected.

Specifically, we expect IoT to impact three main areas within industrials: building automation, manufacturing, and resources. Factories and industrial facilities will use the IoT to improve energy efficiency, remote monitoring and control of physical assets, and productivity.

With several infrastructure booms coming to an end and rising cross-border competition, industrial companies are looking for new sources of growth. Fixed investment is moving away from traditional capital goods equipment, creating new business models that more seamlessly integrate hardware and software, which support recurring revenue streams and greater customer stickiness.

As with any gold rush, the early winners from the IoT are likely to be the suppliers selling the “shovels” to make the connections possible and to process the vast amounts of data. But in the long run, the ultimate impact of this third wave of the Internet depends on the adopters in these proving grounds finding gold in connecting billions of devices into an intelligent network.

This article is drawn from a series of Goldman Sachs research reports on the Internet of Things that has included contributions from more than 20 analysts across multiple sectors.